Copyrights 2022/23: Lexzau, Scharbau GmbH & Co. KG, Bremen (Germany). Concept and realization vibrio | Imprint | Privacy | Cookie Settings

The electrification of individual transport is having a significant impact on the logistics industry: while automotive logistics, for example, must come to terms with the fact that the number of components in e-vehicles is decreasing, a new challenging growth area is emerging in the hazardous goods sector with battery logistics.

We face enormous climate-related challenges. That’s why the international community agreed to a landmark global climate treaty in 2015. For the first time, all 195 signatory countries pledged to fight global warming. Its goal is to limit global warming to well below 2 °C, but preferably to 1.5 °C, compared with pre-industrial levels. Developing countries and emerging economies receive financial and technical support. Consequently, governments and economies need to work hand in hand, with appropriate legislation creating the right incentives for investment in greener industries. For a long time, due to complacency, denial and dependence on the status quo, this process was unfortunately very slow.

As a result, electromobility in particular – with the goal of emission-free mobility for a sustainable future – is developing in very different ways. The European Union wants to lead the way in this trend reversal and herald the end of the internal combustion engine by eliminating carbon emissions from new cars by 2035. In China, whose images of smog-polluted urban highways are burned into our memories, electrically powered two-wheelers were a common sight on the streets long before the e-bike boom in Western countries. China’s development status and potential should therefore not be underestimated lightly.

We are currently experiencing an e-offensive by manufacturers, especially car manufacturers. But in many countries, the charging infrastructure is lagging behind this rapid development.

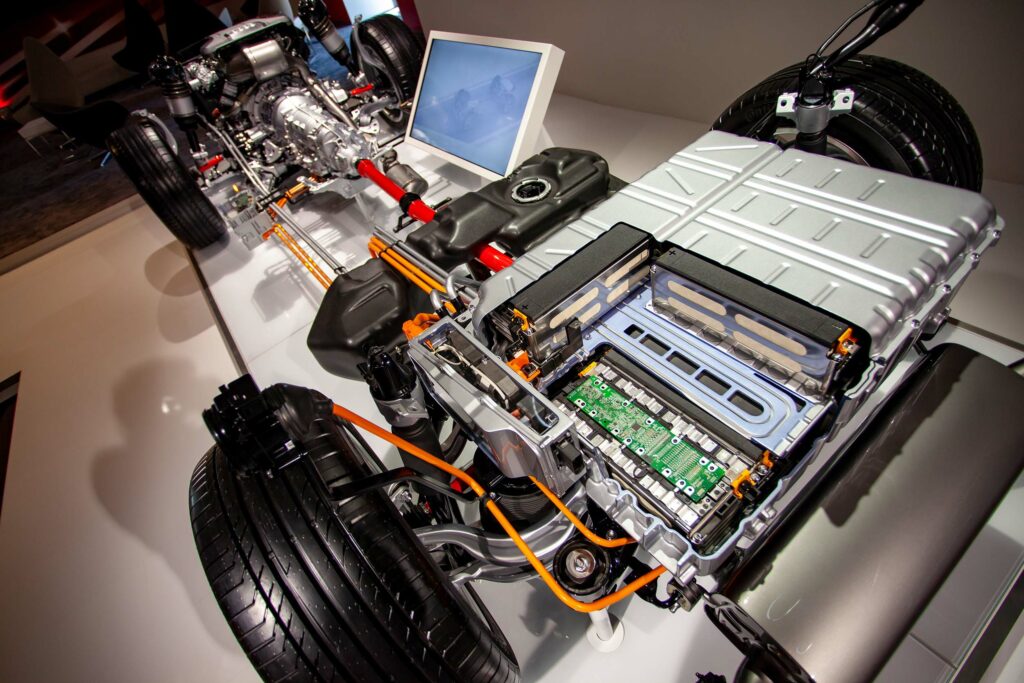

Batteries, especially modern lithium-ion and sodium-ion batteries, play a central role as electrical energy storage devices. The global production volume of lithium-ion batteries alone will increase ninefold to around 9 TWh by 2030. More than half of this production will come from China. Currently, there are battery projects in Germany in the order of about 480 GWh, and that is still more than three times as much as in the UK, the next country in the European ranking, with about 145 GWh.

As production grows, so do logistics companies. We see this in Germany with the example of Tesla. In the run-up to the planned commissioning of the Tesla Gigafactory in Grünheide, Brandenburg, logistics capacities in the region were greatly expanded. Tesla itself secured several acres in adjacent areas. Logistics companies already located there wanted to participate in this development with several additional 10,000 square meters of logistics space for Tesla-related services. As promising as the logistical prospects in this area may be, the challenges should not be underestimated. On the one hand, automotive logistics is changing rapidly with electric vehicles, and specialization can leave logistics companies vulnerable to market, macroeconomic or societal changes. Those logistics service providers that specialize in automotive logistics, for example, will have to quickly change their operating models: Assembly line delivery of just-in-time components has had its day, as battery-electric models require far fewer parts. Vehicles with internal combustion engines have more than 2,000 moving parts in the powertrain, compared with only about 20 for battery electric vehicles, which inevitably affects the logistics resources required.

Another problem with electrification is the various safety risks. Fire protection requirements demand solutions from all parties involved; i.e. authorities, manufacturers, logistics companies and insurance companies. The energy density of lithium-ion batteries has tripled in recent years. Handling has become more demanding, as batteries can be sensitive to shock, pressure and temperature. Battery fires, including those caused by spontaneous combustion, can cause great damage. The reactions in the event of a battery fire are described by the German Association for Technical Fire Protection (BVFA): According to this, high temperatures of more than 800 degrees Celsius can occur on the surface of the battery cells due to heat, overcharging or mechanical damage. This allows the cell to open and eject its contents to the outside under overpressure. The harmful, white-gray smoke that comes out contains battery ingredients and decomposition products. Burning lithium-ion batteries are best extinguished with plenty of water and by depriving them of oxygen. Even though oxygen reduction offers a time advantage and prevents the ignition of neighboring fire loads, water is currently the extinguishing agent of choice for experts. It cools down and thus prevents a thermal chain reaction of further batteries and thus the spread of the fire. Alternatively, other extinguishing agents such as fire blankets are tested.

The disposal of the heavily contaminated extinguishing water after a battery fire, the contamination of the logistics property and the corresponding downtime also require safe solutions in battery logistics. Cooperation with authorities and the local fire department as well as targeted training of personnel in fire protection, are essential for the logistics service provider. The primary goal, of course, is to prevent a fire. The digitization of battery logistics plays an important role here. For example, automated monitoring of the logistics property using smoke and temperature sensors as well as modern camera systems can detect overheating and smoke development at an early stage, sound the alarm and thus trigger the initiation of appropriate countermeasures.

Currently, there is still a lack of logistics service providers that are appropriately certified and staffed for the proper handling of batteries. In addition, there is still a widespread lack of suitable logistics properties that meet the required security standards. Rising demand is expected to spur the industry, but a lack of public regulations for the proper storage of lithium-ion batteries is still making potential progress very difficult. Logistics service providers therefore reduce the storage volume as much as possible and separate the storage area in terms of fire protection. Many logistics companies are still hesitant to invest in well-equipped larger facilities for battery logistics, preferring to wait and see what later regulations dictate before they may be at a disadvantage. It is not always necessary or advisable to build a new facility to meet necessary or advanced fire protection measures. If necessary, existing properties can also be retrofitted according to fire department and insurance guidelines.

After a life cycle of five to eight years, the batteries enter the recycling market as returns. Valuable secondary raw materials such as lithium, copper, lead, sulfuric acid, steel, ferromanganese, nickel, zinc, cadmium as well as mercury can be reused in a recycling process for battery and accumulator production. The most common process to date is thermal fusion. In this process, the battery is first burned and then crushed. Different standards and sizes of manufacturers complicate recycling, as the furnaces used sometimes reach the limits of what is physically possible. Therefore, the demand for supporting, upstream value-added logistics services, such as modularization, will increase exponentially.

Currently, there are hardly any logistical solutions for spent batteries. They are waste under the Basel Convention and require complex approval procedures. More secure transport containers that can monitor the condition of the batteries inside by means of built-in sensors are a good approach. Such a transport container currently still costs up to several tens of thousands of euros, which is why good container management along the reverse supply chain is necessary to minimize the capital tied up. Such containers could be an important step in battery logistics towards safe and standardized transport chains for used batteries.

At the moment, determined logisticians like Leschaco are faced with time- and resource-intensive “greenfield” solution concepts. However, the new battery regulation passed by the EU Parliament is likely to bring about a fundamental change in the recycling market. Ambitious collection targets and strict recycling requirements were adopted in early March. For example, minimum collection rates for spent portable batteries are to increase to 70 percent by the end of 2025 and 80 percent by 2030. The targets for recycling spent batteries are also ambitious for lithium products. For example, the material-specific minimum recycling rate is to be 70 percent from 2026 and even at least 90 percent of the lithium contained in batteries and accumulators from 2030. Stricter guidelines are also to apply to the nickel-cadmium sector, such as a minimum recycling rate of 85 percent from 2025.

Battery logistics has so far been a niche market, especially for spent batteries. However, it will develop quickly due to the climatic and resulting political conditions. It remains to be seen to what extent this trend will be dampened by the parallel further development of hydrogen technology. Field trials with this alternative type of drive are already underway in the truck sector. It is also another indicator of the extinction of the internal combustion engine. Logistics companies that are aware of this development and adapt to it at an early stage will have clear competitive advantages.

Illustrations © Negro Elkha – stock.adobe.com and fotoatelier.hamburg – stock.adobe.com

The Leschaco Group is a global logistics service provider that combines Hanseatic tradition with cosmopolitanism and a spirit of innovation. “Experienced. Dedicated. Customized.” This is a fitting summary of the company’s philosophy: On the basis of decade-long experience teams of specialists set up customized solutions

› Sea Freight

› Air Freight

› Tank Container

› Contract Logistics

› Supply Chain Solutions

› Intermodal Transports

› Industrial Solutions

› Services

Lexzau, Scharbau GmbH & Co. KG

Kap-Horn-Straße 18

28237 Bremen

Deutschland

phone (49) 421.6101 0

fax (49) 421.6101 489

info@leschaco.com

Copyrights 2022/23: Lexzau, Scharbau GmbH & Co. KG, Bremen (Germany). Concept and realization vibrio | Imprint | Privacy | Cookie Settings